If SME funding in the Nigerian printing industry were a person, it would be that uncle at family gatherings who promises big things but only shows up with a bottle of soda—sweet but not exactly what you had in mind. The truth is, for many small and medium-sized businesses in the printing industry, getting adequate funding has always been like chasing rainbows in a desert. It’s there, but the very best of good luck finding it.

Today’s Situation: “The Art of Struggling and Making it Work… Barely”

Picture this: A small printing business somewhere in Lagos, Owerri, or Kano, is armed with a trusty (but ancient) printing machine that’s been cranked more times than an overused okada. Every morning, the owner, let’s call him Baba Press, whispers a prayer as he flips the switch, hoping the machine doesn’t cough, catch a fever, sputter, and die like a battered “I better pass my neighbour” generator. Yet, Baba Press is a survivor. With limited funding, no government loans, and little support from financial institutions, he’s built a legacy out of pure grit, spicy jollof rice, and maybe some divine intervention. Halleluyah!

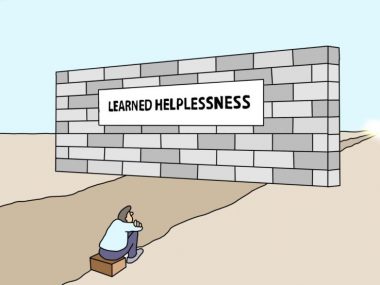

But here’s the thing—funding for SMEs in the printing sector is currently about as elusive as an umbrella during a Lagos downpour. Sure, there are banks that say they provide loans. But in reality, accessing these funds can feel like applying to the Avengers—only those with “perfect” credit scores, mind-bending collateral, and the ability to answer very twisted riddles from bank managers get in.

As it stands, most SME printers are stuck juggling: High costs of machinery and materials (hello, ink and paper prices! How market with todays exchange rate?).

Manual labour that feels like the industrial age came for a visit and never left, and

Unpredictable cash flow (cue every printer’s favorite: waiting months for payment while still footing outrageous Electricity bills).

Yet, these resilient business owners still find a way to stay in the game, their creativity unfurling like a fresh roll of vinyl.

To say the least, most print businesses are on their own, duking it out for the smallest scraps of financing. Banks, in all their wisdom, love the idea of supporting SMEs…on paper ofcourse… But when you walk into that banking hall with your business plan, suddenly it feels like you’re asking for a matching kidney, not a loan.

Some of the hoops you must jump through! A business plan that could rival a PhD thesis, collateral you probably don’t have (hello banker, I’m a small business, remember?), and then interest rates so high you might as well be printing money for the Central Bank. Let’s not even get started on the “angel investors” who want to own your soul in addition to your spirit and body in exchange for funds.

So, for many small printers, funding today feels more like a fancy fairy tale. You hear about it, but you’ve never actually met anyone who’s received it. Instead, you bootstrap, hustle, and maybe sell a kidney (don’t worry, you have two!) to keep your business afloat.

The Future: Funding Paradise

But here’s the thing—what if funding in the printing industry could be transformed? What if it wasn’t a mythical creature you dream of finding, but a regular visitor who helps you grow? Picture this: A system where funding is not just accessible but tailored to the unique needs of the printing industry.

Imagine walking into a bank, and instead of being met with raised eyebrows when you say “printing press,” you’re greeted with excitement. Loans could be customized for different kinds of printing businesses—from the guy with the corner shop DI to the large-scale digital printer working on high-end packaging. Better yet, interest rates that won’t make you weep into your ink cartridges.

What if it could be “The Golden Era of Printing”?

Let’s dream a little. What if SME funding wasn’t a pipe dream? What if printers could access proper financing without needing to pledge their firstborn children as collateral?

First, imagine banks and government agencies actually understanding printing (stay with me, I know it sounds wild). But today they don’t recognize the potential of the industry, neither do they see the cha-ching of profit, otherwise they would have started dishing out tailored loans with reasonable terms—yes, that’s right, reasonable…

With access to real capital, Baba Press can toss out that clunky old machine that sounds like it’s permanently stuck in reverse gear. Instead, he upgrades to modern printing equipment: CtP technology, digital presses, automated finishing. His works! His productivity soars, and those long waits to complete orders? History

Enter government intervention (cue superhero music). What if government policies provided grants and low-interest loans specifically for SMEs in printing? I mean, we’re literally helping businesses get their messages out there, whether through banners, books, or even packaging that makes you grab that extra biscuit off the shelf. Imagine tax breaks, subsidies (no, not that sacred oil industry term), let’s just say zero duty on printing equipment for SMEs. Now, wouldn’t that be something?

Better still, what if venture capitalists saw the potential in printing? No, not the type who invest in apps that tell you when you need to brush your dogs teeth—but the type who understand that there’s still value in physical, tangible products. Packaging alone could turn investors into “print-aholics,” recognizing how this sector is key to branding, product go-to-market and sales.

A Print Revolution

Transformation would mean moving from just surviving to thriving. Printers could finally upgrade their equipment—say goodbye to that ancient press that wheezes like a retired wrestler. Imagine running your business without the constant dread of breakdowns because you’ve got quality machines with expert after sales support.

Let’s take it further: With proper funding, the print industry could embrace automation, eco-friendly inks, and energy-efficient presses. Print businesses would not only be more profitable but also help save the environment—cue applause from your environmentally conscious customers.

Picture collaborations between big printers and small ones, with the latter not begging for crumbs but standing tall because they’ve got the funding to compete. The Nigerian printing industry could go from “Please sir, can I have some more?” to “Oh, you need a thousand brochures by tomorrow? No problem!”

And how about expanding into new territories? Augmented reality, AI, 3D printing, anti counterfeiting labels, digital prints for fashion, software driven production, more personalized printing services—the sky’s the limit when you’ve got the right funding.

Funding for All: No Printer Left Behind

Ultimately, the transformation of funding for Nigerian printers is more than a pipe dream. It’s about making the entire industry more vibrant, competitive, and, dare I say, fun. Because who says running a print shop can’t be fun when you’re not stressing about money all the time?

So, here’s to the day when printers no longer need to beg, borrow, and barter to keep their machines running. When the industry is thriving not because of sheer determination, but because the right financial support exists. It’s time for SME funding to stop being that elusive uncle and start being a reliable partner.

And when that day comes, we’ll be here. Pressing forward, printing better, and maybe—just maybe—taking a moment to laugh at the wild ride it took to get there. May I add that an industry who won’t allow it’s Institute to stand and do its job of advocacy and government diplomacy for the benefit of us all is indeed wasted!

End of transmission. Go print this article on a well-funded machine!